Imagine a time when one company controlled vast territories, maintained armies, and governed whole regions, all while making financial history. This was the Dutch East India Company (In Dutch, Vereenigde Oost-Indische Compagnie or VOC), a business titan that revolutionized modern finance, governance, and the very nature of international trade.

Founded in 1602, it became the first multinational corporation and, at its peak, was valued at over $8.2 trillion in today’s dollars, a feat that remains unmatched in corporate history. Today, companies like Apple, Amazon, and Microsoft wield similar influence, controlling vast portions of global wealth and economies.

But what exactly made the VOC such a monumental entity, and what can we learn from its rise and fall? Let’s take a closer look at this pioneering company and its lasting impact.

The Birth of a Corporate Giant

In the late 16th century, European powers were scrambling to secure trade routes to Asia, seeking to profit from valuable commodities like spices and silk. The VOC was born out of this need, combining private investment with government support to launch an expedition that would shape global trade.

The company was granted a state-issued charter that gave it monopoly rights over Dutch trade in Asia, along with unprecedented powers. It could wage wars, sign treaties, govern colonies, and maintain its own army and navy. In essence, the VOC was both a corporation and a state actor, a unique combination that set it apart from any modern enterprise.

What Was Unique About the VOC?

The VOC’s operations were grounded in a unique set of legal and governance structures that blended corporate and governmental powers. This made it a precursor to modern multinational corporations, yet it also had distinct powers that no corporation today would possess.

Key Constitutional Foundations of the VOC:

- State Charter (1602): The Dutch government granted the VOC a charter that gave it exclusive rights to trade in the East Indies, effectively functioning as a quasi-constitution. The charter defined its legal authority, governance, and commercial privileges, and was renewed every 21 years.

- Monopoly and Sovereign Powers: The VOC held a legal monopoly over Dutch trade in Asia, and was authorized to:

- Wage war and sign treaties (effectively acting as a state).

- Govern overseas territories (especially in Indonesia and South Africa).

- Maintain a private army and navy.

- Mint its own currency.

- Operate courts and enforce laws.

This combination of corporate and sovereign powers was unique in the business world and set the VOC apart from any company operating today.

The Corporate Structure: A Precursor to Modern Business

The VOC was the world’s first joint-stock company, and its structure laid the foundation for the way corporations operate today. By selling shares on the Amsterdam Stock Exchange, the company made it possible for ordinary people to invest in its ventures, democratizing the concept of business ownership. This model of collective ownership and risk-sharing was revolutionary and directly influenced the development of modern capitalism.

The VOC was governed by a board of directors known as the "Gentlemen XVII" (Heeren XVII), which included representatives from various Dutch provinces. This decentralized approach to management allowed for a more balanced distribution of power among investors, and it established a model for corporate governance that still resonates in today’s multinational corporations.

The Impact on Trade and Global Expansion

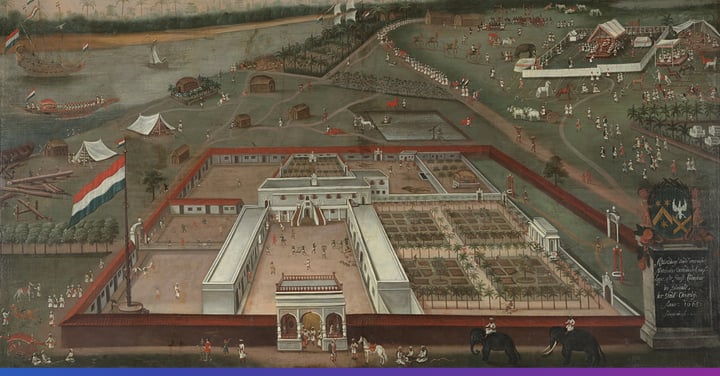

With its monopoly over Dutch trade in Asia, the VOC was able to establish a vast network of trading posts and colonies across the East Indies (modern-day Indonesia), South Africa, and beyond. The company’s trade routes connected Europe to the riches of the East, fundamentally altering global commerce. It was the driving force behind the European colonization of parts of Southeast Asia and Africa, shaping the economic and political landscape for centuries to come.

Through its powerful fleets, the VOC was not only a merchant enterprise but a military one as well. The company’s private army and navy were instrumental in protecting trade routes and enforcing its dominance over local populations, especially in regions like Indonesia and South Africa. The company’s influence reached far beyond the boardroom, extending into the geopolitical sphere, which set it apart from any modern corporation.

The Decline: A Cautionary Tale

However, as powerful as the VOC became, its eventual decline is a cautionary tale about the risks of corporate overreach and mismanagement. The company’s downfall was brought about by a combination of corruption, internal strife, and external pressures, including military conflicts and competition from other European powers. By the time it was nationalized in 1795, the VOC had lost its grip on the global trade empire it once commanded.

While the VOC’s financial success during its heyday was immense, its legacy serves as a reminder that businesses must remain vigilant in their operations and governance. Over time, the company’s immense power became a burden, and its inability to adapt to changing conditions ultimately led to its dissolution. Today, as we consider the importance of responsible governance and sustainable growth, the lessons from the VOC are as relevant as ever.

The Influence on Modern Corporations and Governance

What can modern enterprises learn from the VOC’s story? For one, the VOC’s blend of corporate and sovereign powers was unique, but it also highlighted the need for clear governance structures and oversight. The VOC’s success was due in part to its ability to manage vast, multinational operations and incorporate diverse stakeholders. However, as its power grew, so did its challenges, especially in terms of accountability and ethical responsibility.

In today’s world, corporations may not have armies or sovereign powers, but they still wield significant influence on global economics, politics, and social issues. Modern enterprises, especially those operating in multiple countries and sectors, must navigate complex governance structures and embrace transparency, ethics, and sustainability in their operations.

The story of the Dutch East India Company (VOC) serves as a powerful reminder of the immense influence corporations can wield over trade, governance, and global economies. In modern times, tools such as corporate registers, lobbyist registers, and other transparency initiatives are crucial in ensuring that corporations are held accountable and that their power is managed responsibly. These tools provide visibility into corporate activities, ownership structures, and their influence on government policies, regulating the impact a company can have on the economy and political landscape.

Just as the VOC once operated with significant autonomy, modern businesses are now subject to these transparency measures to ensure they do not overstep their boundaries. The rise of responsible investing and environmental, social, and governance (ESG) frameworks reflects the lessons learned from historical giants like the VOC, encouraging a more accountable and sustainable approach to corporate power.

The Learnings: A Legacy of Innovation and Caution

The Dutch East India Company was not just a symbol of wealth and power, it was a pioneer in corporate governance, finance, and global trade. Its success and eventual failure offer valuable insights into the complexities of managing large, multinational organizations. As we look to the future of business, the VOC’s story reminds us of the importance of balance, between innovation and responsibility, between growth and sustainability.

Just like today’s multinationals, such as Apple, Amazon, and Microsoft, the VOC’s rise and fall serve as both a blueprint for success and a warning about the potential perils of unchecked corporate power. The lessons from the VOC are as relevant today as they were centuries ago. As we continue to navigate the ever-changing landscape of business and technology, we can draw inspiration from the VOC’s legacy of innovation while being mindful of the risks that come with immense power and influence.

The VOC may be gone, but its story is timeless, offering crucial insights for today’s business leaders and investors.

--

At Foster Moore, we care about governance, transparency, and responsible business practices. Inspired by the lessons of the VOC and others, we help organizations drive digital transformation with solutions that promote accountability and sustainable growth.

Ready to modernize your registry? Let’s talk.