Introduction

Around the world strengthening director identification, and the use of director identification numbers, has been on the cards for some time.

As the world connects and more business is done globally, there is a growing mandate to increase integrity, transparency, and trust in registry data.

Identification of directors is a key component, sitting alongside the challenge of identifying the true owners of a company (beneficial owners).

This paper looks at the challenges around director identification using the Australian lens and introduces the response the Australia Taxation Office (ATO) is implementing to address those challenges.

The case for reform

Being a director is a vital role.

Directors are responsible for oversight of the affairs of the company. They must comply with legal obligations, must be up to date on what the company is doing, must not use their position as to cause detriment to the company or to gain an advantage for them self or someone else.

For at least 30 years Australian law has required director details to be lodged with the regulator, the Australian Securities and Investments Commission (ASIC). The information required includes the director’s name, date and place of birth, residential address, and role. This information is made publicly available and provides important insights for those doing business with a company.

But Australian law has not required that the information lodged be verified by the regulator. In simple terms, the information lodged is accepted by the regulator at face value.

This has led to a number of issues:

• The use of false or fraudulent director identities, such as Mickey Mouse and Porky Pig,

• Tracking problems, with inconsistent director information for the same person making it hard to trace directors across companies over time, and

• Unlawful activities involving directors, such as illegal ‘phoenix’ activity.

This illegal practice usually happens when company directors abandon or transfer the business assets of an existing company to a new company without paying true or market value, leaving debts with the old company. Once the assets have been transferred, the old company is placed in liquidation or abandoned. If the liquidator is appointed, there are no assets to recover, meaning creditors cannot be paid.

Although Australian law has prohibited the provision of false or misleading information under the criminal code, the requirement to verify a director’s identity has been long overdue and has been welcomed by the business community.

Why introduce a Director ID?

Australia started tackling these challenges through taskforces, policy, and legislative changes. Several initiatives were introduced to deter and penalize phoenix activity and to protect those who are negatively affected by such fraudulent behavior. A key initiative is the introduction of a director identification regime (director ID).

The director ID will require all directors to confirm their identity. It introduces a unique identifier for each person who consents to being a director. The person will keep that unique identifier ‘for life,’ even if their directorship with a particular company ceases.

In addition to ensuring the director is a real person, the director ID will provide traceability of a director’s relationships across companies, enabling better tracking of directors of failed companies and preventing the use of fictitious identities. This will assist regulators and external administrators to investigate a director’s involvement in what may be repeated unlawful activity including illegal phoenix activity. It will also increase the value of public information for its users.

In summary, the director ID will:

• Provide an accurate way to distinguish between directors with similar names,

• Help identify which directorships a person holds, linking a person across companies and roles,

• Make it easier for creditors, and others doing business with a company, to track a director,

• Help government agencies to identify, locate and challenge those who misuse companies including directors, and identify cases for action,

• Increase the accuracy of registers,

• Make it easier to identify people disqualified from being a director,

Benefits for Directors

The ability to confirm relationships between a director and the companies for which they are appointed introduces an ability to improve services to those directors. Being able to update their details in one place and have those details ‘cascade’ across their various companies will save the individual time, improve compliance, and enhance the accuracy of the data held by the business registry.

How director ID works?

An Australian director ID is a 15-digit identifier given to a director (or someone who intends to become a director) who has verified their identity. A director ID starts with 036, which is the 3-digit country code for Australia under International Standard ISO 3166 and ends with an 11-digit number and one ‘check’ digit for error detection.

Director ID is required by an eligible officer (director or alternate director) of a company, a registered Australian body, a registered foreign company, or an Aboriginal and Torres Strait Islander corporation. For example, United States’ citizens who are also directors of Australian companies or foreign companies registered in Australia must be identified.

Directors need to apply for their own director ID – they cannot outsource this to an agent. It is free to apply.

Directors will only ever have one director ID. They will keep it forever even if they: change companies, stop being a director, change their name, or relocate.

It is a three-step process to get a director ID and once ready it can be done in minutes.

- Step one is to set up a myGovID if the person does not already have one. myGovID is the Australian government’s app. That lets a person prove who they are and log in to a range of government online services

- Step two is to gather required documents, such as the person’s tax file number (TFN), residential address as held by the Australian Taxation Office (ATO), and information from two permitted documents to verify identity

- Step three is to complete the application online, which can take less than 5 minutes.

Paper based and alternative processes are available for some directors, including directors residing outside of Australia who cannot get a my GovID and need to provide certified copies of identity documents.

Building and administering the director ID regime

The introduction of the director ID is part of a broader multi-year program to modernize Australia’s Business Registers (MBR Program).

The MBR Program will unify 32 Australian business registers onto a single platform hosted by the Australian Taxation Office and includes the introduction of the director ID as an early deliverable commenced in late 2021. Foster Moore is a key delivery partner on the program, our Verne® Registry Aware™ platform has been selected by the ABRS as the core registry technology.

In April 2021, the Commissioner of Taxation was appointed as the Commonwealth Registrar (the Registrar) of the Australian Business Registry Services (ABRS). The ABRS is now responsible for administering the director ID initiative which commenced in late 2021.

Enforcing the Director ID regime

The new ABRS agency is providing support and guidance to directors to assist them to understand and meet their director ID obligation. At the right time, non-compliance will be addressed using tools that include civil and criminal penalties.

Director ID obligations imposed onto a director include:

• Applying for a director ID within the relevant timeframe

• Applying for a director ID when directed by the Registrar to do so

• Not applying for more than one director ID (unless directed by the Registrar to do so)

• Not misrepresenting the director ID to a Commonwealth body, company, registered Australian body or Aboriginal and Torres Strait Islander corporation

• Not being involved in a breach of director ID obligations.

Transitional provisions guide when directors much apply for the new Director ID. Existing directors have been given almost a year to apply. Ultimately, intending directors will need to get a Director ID before being appointed.

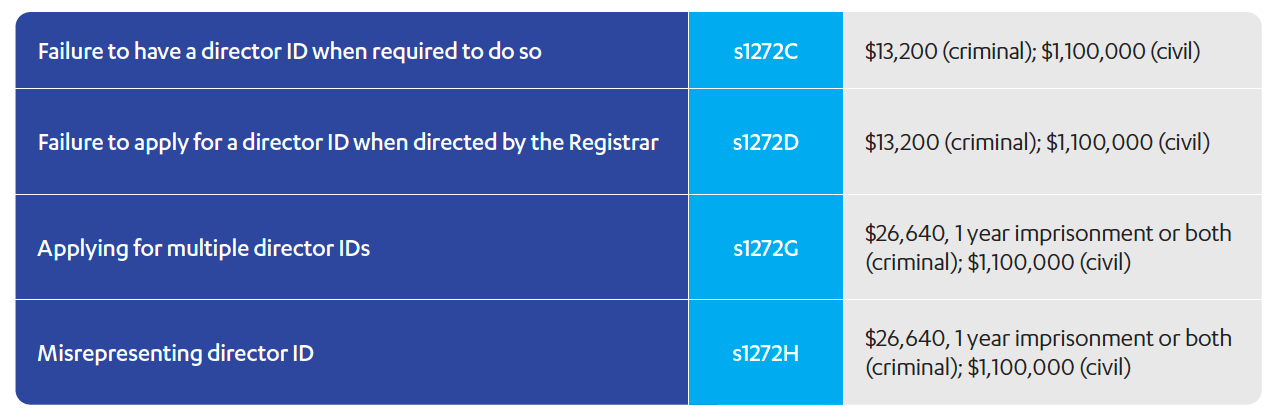

ASIC will be responsible for enforcing four new director ID offences set out in the Corporations Act 2001:

Conclusion

Director identification is an important mechanism to increase the trust in registries that support doing business locally and globally. The introduction of a director ID in Australia is part of a multi-year program to modernize Australia’s business registers.

For questions, comments and further discussion please contact:

Justin Hygate, VP Registry Innovation justin.hygate@fostermoore.com